3 min de lectura

Long Position, Block Explorer, Isolated Margin

CRYPTOCURRENCY

Cryptocurrency Market Dynamics: Understanding Long Positions, Block Explorers, and Isolated Margins

The world of cryptocurrency has undergone significant transformations in recent years, with blockchain technology gaining widespread acceptance and mainstream popularity. Among the various trading strategies employed by investors is the concept of long positions, which involve buying assets with the expectation of holding them for an extended period. In this article, we will delve into the realm of cryptocurrency market dynamics, exploring key concepts such as block explorers, isolated margins, and their role in facilitating efficient trading.

Long Positions

A long position involves a trader’s investment that aims to benefit from the upward movement of a particular asset or market trend over time. In the context of cryptocurrencies, a long position typically means buying a cryptocurrency with the intention of holding it for an extended period. This strategy is often employed by institutional investors and sophisticated traders who seek to profit from price appreciation.

The benefits of long positions in crypto markets include:

- Potential for substantial returns: Long-term investments can yield significant profits when executed correctly.

- Reduced market risk: By diversifying across multiple assets, traders can mitigate their exposure to any single market fluctuations.

- Flexibility: Long positions allow traders to adjust their portfolios as market conditions change.

However, long positions also come with inherent risks:

- Price volatility: Cryptocurrency markets are known for their high price fluctuations, making it challenging to predict future prices.

- Liquidity constraints: Some cryptocurrencies may experience reduced trading volumes or liquidity, hindering the ability to quickly sell or buy assets at favorable rates.

- Regulatory uncertainty: Governments and regulatory bodies often introduce new rules and regulations, affecting market dynamics and investor sentiment.

Block Explorers

A block explorer is a crucial component of cryptocurrency networks, responsible for validating transactions and updating the blockchain ledger. Block explorers enable users to browse through transaction history, access block details, and track the progress of their favorite coins. Popular block explorers include:

- Ethereum Gas Station: A popular platform for exploring Ethereum transactions.

- Blockexplorer.io: An online explorer that provides detailed information on various cryptocurrencies.

Using a block explorer can help traders:

- Verify transaction history and transaction fees

- Track the progress of their favorite coins

- Stay up to date with market news and price movements

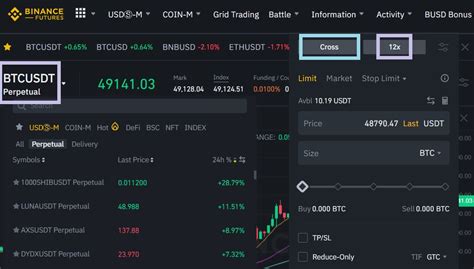

Isolated Margins

Isolated margins refer to the practice of maintaining multiple accounts within a single brokerage firm, each representing different cryptocurrencies. This strategy allows traders to manage risk while still benefiting from leverage in one account.

The benefits of isolated margins include:

- Reduced reliance on a single account: By separating assets across multiple accounts, traders can minimize their exposure to any particular market.

- Increased flexibility: Isolated margin strategies enable traders to adjust their portfolios as market conditions change.

- Simplified risk management: Traders can more easily monitor and manage their positions within one account.

However, isolated margins also have some drawbacks:

- Higher fees: Using multiple accounts may incur higher transaction fees or interest charges.

- Complexity: Managing multiple accounts can be complex and require significant time and effort.

In conclusion, cryptocurrency markets are inherently volatile and subject to various risks.