3 min de lectura

Market Maker, Testnet, Market Correlation

CRYPTOCURRENCY

Here is an article about crypto market makers, testnets, and market correlation:

Title: The Role of Crypto Market Makers in Cryptocurrency Market Dynamics

Introduction:

Cryptocurrencies have received significant attention in recent years, and many people are investing their hard-earned money in these digital assets. However, navigating the complex cryptocurrency market can be daunting even for experienced investors. In order to mitigate potential losses and maximize profits, it is essential to understand the role of Crypto Market Makers (CMs) in the market dynamics.

What are Crypto Market Makers?

A Crypto Market Maker is an individual or institution that provides liquidity for a particular cryptocurrency by offering to buy and sell it at the prevailing market price. In exchange for their services, CMs are typically paid a margin call, which requires them to deposit more money into their accounts. This process allows the market to adjust to changes in supply and demand.

Crypto Market Maker (CM) Model:

The traditional Crypto Market Maker model involves buying and selling a cryptocurrency at prevailing market prices, thereby providing liquidity and facilitating trading activity for other investors. CMs may earn income from fees generated from transactions, as well as interest on their deposited funds.

To operate effectively, CMs must be aware of the market’s price dynamics and adjust their strategies accordingly. They must stay up-to-date on market news, sentiment analysis, and technical indicators to make informed decisions about when to buy or sell.

Testnet:

A Testnet is a simulated environment that mimics the operation of a live cryptocurrency network, but without the actual deployment of real assets. Crypto market makers can test their strategies on the Testnet before investing in live markets, allowing them to refine their approaches and reduce risks.

By testing their models on the Testnet, CMs can validate assumptions about market dynamics, optimize their strategies, and prepare for potential challenges that may arise in the live market.

Market Correlation:

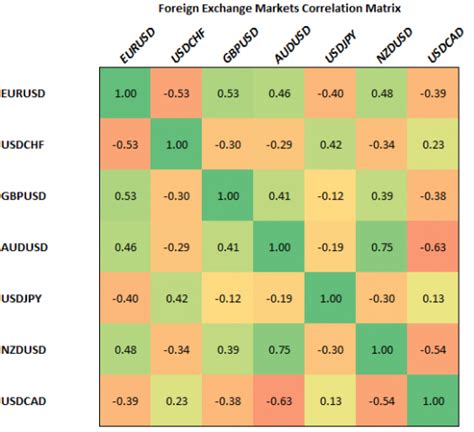

Market correlation refers to the statistical relationship between the price movements of two or more assets. Crypto market makers often use technical indicators and market analysis tools to identify patterns and relationships between different cryptocurrencies. By analyzing market correlation, CMs can gain insight into potential trading opportunities and minimize losses by avoiding excessive leverage.

Example Use Case:

Let’s say we have two cryptocurrency pairs with a high correlation coefficient (0.95): Bitcoin (BTC) vs. Ethereum (ETH). This means that the price movement of BTC is highly correlated with ETH, indicating a bullish trend when one pair goes up and the other follows suit. In this scenario:

- A Crypto Market Maker might consider buying BTC and ETH to take advantage of the strong correlation.

- However, if the Bitcoin price in the market suddenly drops (due to increased selling pressure or regulatory concerns), this could lead to losses for CMs who have significantly invested in ETH.

Conclusion:

Crypto market makers play a crucial role in driving market dynamics by providing liquidity and facilitating trading activity. Understanding their strategies, models, and risk management techniques can help investors navigate the complex cryptocurrency landscape. By leveraging Testnets and analyzing market correlation, Crypto Market Makers can make informed decisions about when to buy or sell, minimizing potential losses and maximizing profits.

Recommendations:

- Stay up to date with market news: Constantly monitor cryptocurrency market trends, sentiment analysis, and technical indicators.

- Test your strategies on Testnets: Validate assumptions about market dynamics before investing in live markets.

3.